In today’s financial landscape, getting a pre-approved loan offer in the mail, like those from SilverLake Financial, can seem like a lifeline thrown your way, especially if you’re drowning in debt. These letters, promising low-interest rates and easy debt consolidation, can be incredibly tempting. But here’s something you might not know: these offers, while appealing, can sometimes lead you into deeper financial waters than where you started. It’s crucial to tread carefully.

Many folks see these offers as a quick fix to their financial woes, but the reality can be more complex and, at times, more costly. In this blog post, we’ll dive deep into what SilverLake Financial offers, the potential pitfalls of jumping on a pre-approved loan, and how to navigate these offers wisely.

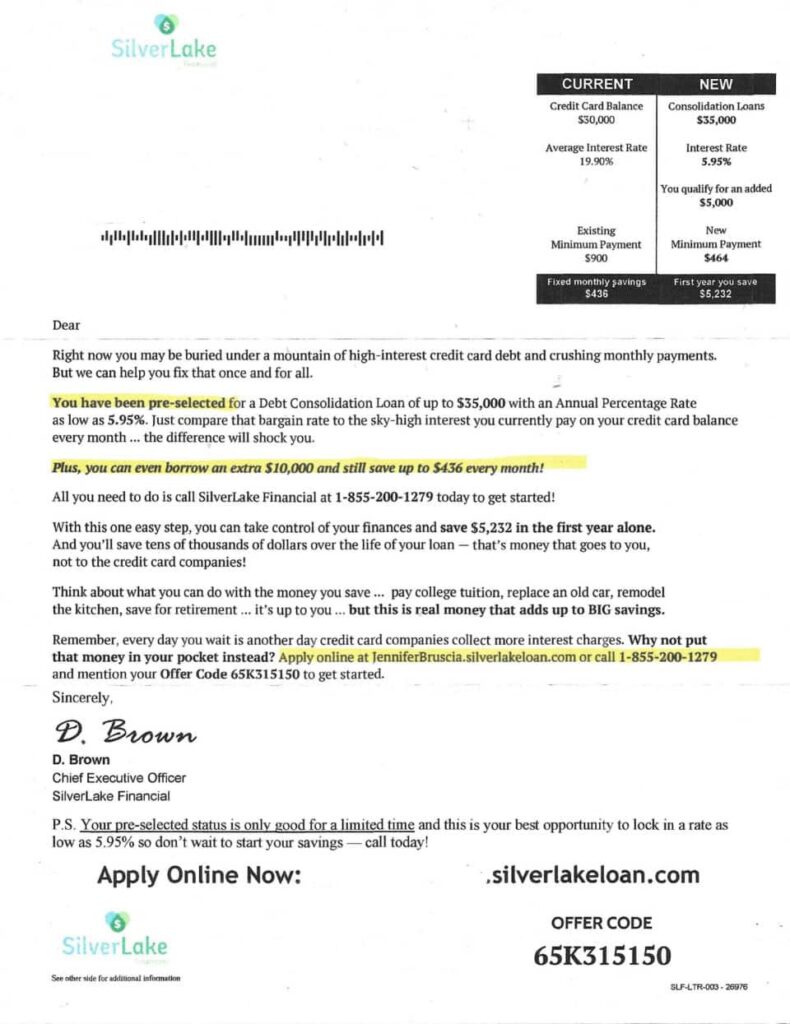

SilverLake Financial’s Pre-Approved Mail Offers

Imagine this: You’ve just grabbed your mail and seen an envelope from SilverLake Financial. It’s a pre-approved loan offer, and the timing couldn’t be more perfect. You’ve been stressing about your piled-up bills and looking for a way out. The letter boasts a low-interest rate, simple terms, and promises of financial relief. It’s almost too good to ignore. But before you jump on board, it’s important to understand what’s at stake.

These mail offers are designed to catch your eye and make you act fast. They talk about low-interest rates and easy debt consolidation, but they often leave out the critical details: the fees, the actual terms once they’ve got you on the phone, and the long-term impact on your financial health. It’s not uncommon for folks to find out that the consolidation loan they thought they were getting is a debt settlement plan that could hurt their credit score and financial stability even more.

Remember, if it sounds too easy, it probably is. Taking a step back and evaluating your options, perhaps even seeking advice, is crucial before making any decisions.

SilverLake Financial Overview

SilverLake Financial, at its core, is a company that steps into the financial scene with a promise to help individuals manage and overcome their debt. While the specifics of their office location and contact numbers aren’t readily available in the public domain, their presence in the debt relief industry is notably marked by their active engagement through direct mail offers. To reach out or learn more about what they offer, one would typically find contact information through their official communications or by visiting their website.

As a relatively new player, having ramped up activities around the end of 2021 and into 2024, SilverLake Financial focuses on offering solutions that seem to bridge the gap between overwhelming debt and financial freedom. However, it’s essential to tread with caution, as the landscape of debt relief is fraught with nuances that could significantly affect one’s financial journey.

For those considering SilverLake Financial’s services, it’s advisable to do thorough research, starting with the initial contact. Ensuring clarity on the terms, understanding the nature of the offer (loan vs. settlement program), and knowing the potential impacts on one’s financial health are crucial steps. While direct contact information may vary, potential clients should look for official sources to initiate any inquiries or services.

Note: As direct information about SilverLake Financial’s office address and contact number is not explicitly available, it’s recommended to approach any communication with the company with a detailed set of questions to ensure you’re making informed decisions based on transparent and complete information.

SilverLake Financial Services

SilverLake Financial aims to stand out in the crowded field of debt relief by offering services tailored to individuals struggling with significant debt. Their main offerings revolve around debt consolidation programs, which are often presented to potential clients through direct mail. These pre-approved mail offer low-interest rates and simplified debt management, promising a smoother path out of debt.

However, it’s crucial to fully understand the nature of these services. While marketed under the umbrella of debt consolidation, some clients have found themselves navigating the waters of debt settlement instead. Debt consolidation usually involves taking out a new loan to pay off multiple debts, ideally at a lower interest rate. On the other hand, debt settlement aims to negotiate with creditors to settle a debt for less than what is owed, which can significantly impact one’s credit score.

Before engaging with SilverLake Financial or any debt relief service, individuals need to clarify which type of service they are being offered. Understanding the terms, the potential impacts on credit, and any associated fees is crucial to making an informed decision that aligns with one’s financial goals and circumstances.

SilverLake Financial Pros and Cons

Navigating financial challenges can be daunting, and while SilverLake Financial offers solutions that seem promising at first glance, it’s essential to weigh the pros and cons before diving in.

Pros:

- Pre-Approved Offers: For many, receiving a pre-approved offer from SilverLake Financial can feel like a ray of hope. These offers suggest a pathway to consolidating debt under what appear to be more favorable terms.

- Potential for Lower Interest Rates: The allure of potentially lower interest rates through their programs can be a significant draw for individuals burdened by high-interest debt across multiple accounts.

Cons:

- Misunderstandings About Services Offered: There’s a fine line between debt consolidation loans and debt settlement programs. SilverLake’s materials might not always make this distinction clear, leading some customers to expect a traditional loan but find themselves in a settlement plan that could affect their credit negatively.

- Lack of Transparency: The excitement of a pre-approved offer can quickly fade when customers realize the details, fees, or terms weren’t as transparent as they hoped. This lack of upfront clarity can lead to unexpected outcomes for their financial health.

- Potential Impact on Credit Score: While consolidating debt might sound ideal, the process—especially if it turns out to be a settlement—can have a detrimental effect on your credit score, making future financial endeavors more challenging.

It’s paramount for anyone considering SilverLake Financial’s services to do thorough research, ask the right questions, and possibly seek independent financial advice to ensure the choice aligns with their long-term financial health and goals.

SilverLake Financial Reviews, BBB Reviews, Trustpilot Reviews

When considering any financial service, especially one that affects your debt and credit, it’s wise to look at what others have to say. Reviews can offer a window into real experiences, beyond the polished promises. SilverLake Financial has its share of reviews across various platforms, each painting a part of the larger picture.

BBB Reviews: SilverLake Financial holds an A+ rating on the Better Business Bureau (BBB), which is a strong indicator of its commitment to resolving consumer complaints and its overall reliability. Customers have praised the company for its effective debt relief strategies and customer service. However, it’s noteworthy that even within this positive framing, there have been complaints. These often revolve around misunderstandings about the nature of the services offered—highlighting a gap between expectations and reality.

Trustpilot Reviews: On platforms like Trustpilot, the narrative continues. You’ll find a mixture of satisfaction and caution. Some reviews highlight the relief and support customers felt, receiving guidance through their debt situations. Conversely, others point to a lack of clarity and communication regarding the services provided, especially concerning the differences between debt consolidation and settlement.

Independent Reviews: Beyond these platforms, independent reviews and financial advice blogs stress the importance of understanding the terms and conditions of any debt relief program. They encourage potential clients to ask detailed questions about the process, potential effects on credit scores, and the timeline for debt relief.

The common thread across all reviews is the necessity of clear, informed decision-making. While SilverLake Financial may offer a path to financial stability for some, it’s crucial to enter into any agreement with a full understanding of the terms, potential impacts, and realistic expectations.

SilverLake Financial Customer Experiences

The journey with SilverLake Financial, as recounted by various customers, offers a mosaic of experiences that shed light on the company’s operations and its impact on individuals’ financial paths. These stories range from expressions of gratitude for a way out of crippling debt to frustrations over misunderstood services and unforeseen consequences.

Positive Experiences:

- Relief and Support: Many customers have shared stories of feeling overwhelmed by their debts and finding a lifeline in SilverLake Financial’s offers. For some, the process led to a significant reduction in their overall debt, coupled with support and guidance from the company’s representatives. These customers often highlight the ease of communication and the personalized attention they received, which made their debt relief journey less daunting.

- Simplified Financial Management: For those who successfully navigated the consolidation or settlement process, the benefit of having a single, manageable payment was transformative. It allowed them to focus on a clear path to financial stability, often with lower interest rates than they were previously juggling.

Challenging Experiences:

- Misaligned Expectations: A common thread among less satisfied customers is the gap between their expectations and the reality of the services received. Some believed they were signing up for a straightforward loan consolidation, only to find themselves in a debt settlement program, which, while helpful for some, wasn’t what they initially sought.

- Credit Score Impact: For customers who entered into debt settlement programs, the impact on their credit scores was a source of regret. While settlement can offer a way out of debt, the temporary decrease in credit score and the mark on their credit history were unexpected and unwelcome consequences for some.

Navigating Decisions: The varied experiences of SilverLake Financial’s customers underline the importance of going into debt relief services with eyes wide open. It’s crucial to ask detailed questions, understand the potential impacts on your financial health, and consider all options before making a decision.

Conclusion

Navigating the world of debt relief can feel like walking through a maze, but companies like SilverLake Financial offer a guiding light to those looking to find their way out. While their pre-approved loan offers might seem like an easy solution, it’s crucial to approach them with caution, armed with all the necessary information.

Remember, understanding the full terms, the impact on your credit score, and the difference between consolidation and settlement is key to making the best decision for your financial health. No matter the path you choose, taking control of your debt is the first step towards financial freedom.

FAQ

Q1: Will working with SilverLake Financial hurt my credit score? A1: It depends on the type of service you’re using. Debt consolidation loans might not impact your credit score negatively if managed properly. However, debt settlement programs, which may be offered, can affect your score due to the negotiation process with creditors that often involves stopping payments temporarily.

Q2: Can I choose between a loan and a settlement program? A2: Yes, but it’s important to discuss your options with SilverLake Financial directly. Understanding the differences and potential impacts of each option on your financial situation is crucial before making a decision.

Q3: How long does it take to see results? A3: The timeline can vary based on the amount of debt and the program chosen. Debt consolidation might provide a quicker path to managing your debts under one payment, while settlement programs might take longer as negotiations with creditors unfold.

Q4: Are there any upfront fees? A4: Details about fees should be discussed directly with SilverLake Financial. Generally, debt relief services might have associated costs, but the specifics can vary.

Q5: What if I have more questions? A5: It’s always a good idea to reach out to SilverLake Financial directly. Make sure to prepare a list of questions you have about their services, fees, and any other concerns to ensure you get all the information you need to make an informed decision.