UPDATED REVIEW AND MAIL OFFER 2024

Have you ever opened your mailbox to find a pre-approved loan offer from Union First Funding? While it might feel like a lifeline or a simple way to consolidate your debts with lower interest rates, it’s crucial to tread carefully.

These offers, though tempting, come with their own set of implications and conditions that could affect your financial health in the long run. In this blog post, we’re diving deep into Union First Funding’s pre-approved mail offers, helping you understand what they entail and the broader context of such financial solutions. Our goal is to empower you with knowledge, ensuring you make informed decisions about managing your debts.

Union First Funding’s Pre-Approved Mail Offers

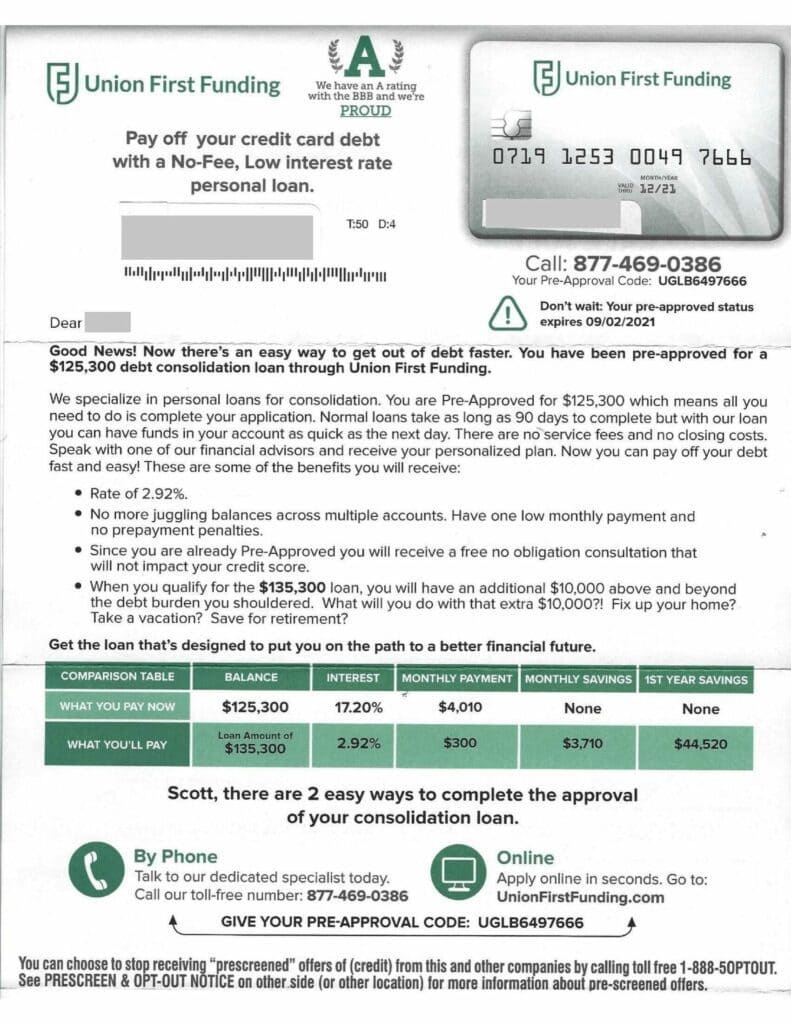

Receiving a pre-approved loan offer from Union First Funding in your mailbox might seem like an unexpected financial windfall. These offers are designed to catch your eye, with promises of easy debt consolidation and attractive interest rates that seem too good to pass up. However, it’s essential to understand the fine print and what these offers actually mean for your financial future.

What are pre-approved offers? These mailers are essentially invitations to apply for a loan that promises to consolidate your existing debts into one manageable payment. The allure of a single monthly payment at a lower interest rate is strong, especially if you’re juggling multiple debts with high-interest rates.

But here’s the catch: These offers are not guarantees of approval. Once you respond, you’ll still need to go through a formal application process, which includes a credit check that could affect your credit score. Moreover, the initial terms outlined in the offer could change based on a closer examination of your financial situation.

Why caution is advised: The terms—especially the interest rate and fees—can be less favorable than they initially appear. It’s also worth noting that consolidating your debts can sometimes extend the repayment period, meaning you could pay more interest over the life of the loan.

Before jumping at a pre-approved offer from Union First Funding or any other lender, it’s wise to shop around, compare your options, and consider the long-term impact on your financial health. Always remember, if an offer seems too convenient, digging a little deeper could reveal it’s not the best choice for your situation.

Union First Funding Overview

Union First Funding stands out in the financial services sector, offering solutions primarily focused on debt consolidation and personal loans. Their approach aims to simplify consumers’ financial burdens by providing a path to combine multiple debts into a single, more manageable loan. This service can be particularly appealing for individuals struggling with high-interest debt across various accounts.

Company Details:

- Address and Contact Information: Union First Funding can be reached at 877-222-0954, signaling their openness to direct communication with both prospective and existing customers. It’s important for borrowers to have accessible channels for inquiries and support, which Union First Funding seems to prioritize.

- Service Offering: The core of their service lies in debt consolidation loans. These financial products are designed to offer consumers a way to bring together various debts under a single umbrella, potentially reducing the overall interest rate and monthly payments. This can not only streamline the repayment process but also offer a clearer path out of debt.

- Client Focus: Union First Funding’s services are geared towards individuals overwhelmed by multiple debts, such as credit card balances, medical bills, and other personal loans. Their target demographic likely includes those looking for solutions to simplify their payments and possibly secure lower interest rates, without the stringent criteria often associated with traditional banking loans.

Understanding Their Offers:

When considering Union First Funding, it’s crucial to comprehensively review their loan offers’ terms and conditions. Interest rates, repayment terms, and any additional fees should be transparent and understood fully before proceeding. Additionally, potential clients should compare these offers with other financial products on the market to ensure they are receiving a competitive deal that suits their specific needs.

Consumer Experiences:

Feedback and reviews from current and past clients can offer invaluable insights into the company’s operations, customer service, and the actual impact of their consolidation loans on individuals’ financial situations. While there are mixed reviews, with some clients praising the simplicity and effectiveness of the services, others caution about reading the fine print and fully understanding the loan terms.

In navigating financial solutions like those offered by Union First Funding, knowledge, and caution are your best allies. Ensuring you have a thorough understanding of their services, terms, and how they fit into your broader financial strategy is crucial.

Union First Funding Services

Union First Funding focuses on providing services that aim to alleviate the financial pressures of debt through consolidation loans and personal loans. Here’s a breakdown of their main service offerings:

Debt Consolidation Loans:

- Purpose: These loans are designed to consolidate multiple debt balances into a single loan with a potentially lower interest rate and simplified monthly payments. This service targets individuals struggling with various high-interest debts, such as credit card balances, medical bills, or other personal loans.

- Benefits: By consolidating debts, clients can benefit from a streamlined payment process, possibly reducing the amount of interest paid over time, and potentially improving their credit score by maintaining consistent, on-time payments.

Personal Loans:

- Flexibility: Union First Funding offers personal loans that can be used for a wide range of purposes beyond debt consolidation, including home improvements, major purchases, or unexpected expenses. This flexibility allows individuals to tailor the loan to their specific needs.

- Terms: The terms of these loans, including interest rates and repayment periods, are determined based on the applicant’s creditworthiness, income, and other financial factors. It’s important for borrowers to review these terms closely to ensure they align with their financial goals and capabilities.

Client Support and Guidance:

- Union First Funding emphasizes customer support, providing guidance throughout the loan application process. Their approach aims to ensure clients understand the terms of their loans and how they fit into a broader financial strategy.

When considering Union First Funding’s services, it’s essential to conduct thorough research and comparisons. Reviewing terms, assessing your financial situation, and possibly consulting with a financial advisor can help ensure that the choice to consolidate debt or take out a personal loan is in alignment with your long-term financial health.

Union First Funding Pros and Cons

Union First Funding, like any financial service provider, comes with its set of advantages and limitations. Understanding these can help you make a more informed decision about their debt consolidation and personal loan services.

Pros:

- Simplified Payments: One of the most significant benefits is the consolidation of multiple debts into a single monthly payment, potentially reducing the hassle of managing several accounts.

- Potentially Lower Interest Rates: For some borrowers, Union First Funding’s consolidation loans might offer lower interest rates compared to the rates on existing debts, potentially saving money over the loan’s life.

- Direct Support and Guidance: The company emphasizes customer support, providing direct assistance and guidance throughout the loan application and management process, which can be valuable for individuals less familiar with financial products.

Cons:

- Varied Customer Experiences: Reviews and feedback from past clients indicate mixed experiences, with some praising the service and others cautioning about less favorable loan terms than initially expected.

- Potential for Higher Overall Costs: While monthly payments may be lower, consolidating debts can sometimes extend the repayment period, potentially leading to higher total interest costs over the life of the loan.

- Impact on Credit Score: The process of applying for a consolidation loan involves a credit check, which can temporarily impact your credit score. Additionally, the effectiveness of using the loan to improve financial health depends on disciplined repayment and financial management.

When weighing the pros and cons of Union First Funding, it’s crucial to consider your financial situation, the specifics of the offer, and how it aligns with your debt repayment and financial goals. Comparison shopping and due diligence can further ensure that you’re making the best decision for your circumstances.

Union First Funding Reviews, BBB Reviews, Trustpilot Reviews

Understanding the experiences of previous and current Union First Funding clients can offer valuable insights into what you might expect. Reviews across various platforms like the Better Business Bureau (BBB), Trustpilot, and other consumer review sites play a crucial role in painting a broader picture of the company’s services, customer satisfaction, and potential areas of concern.

BBB Reviews:

- Union First Funding is not BBB accredited, a detail that might concern potential clients. Reviews and complaints on BBB can range from customer service issues to discrepancies between promised and actual loan terms. It’s essential to read these reviews critically, understanding that experiences can vary widely among borrowers.

Trustpilot Reviews:

- The company has a presence on Trustpilot, where reviews are mixed. Positive reviews often highlight satisfactory loan terms, ease of the application process, and helpful customer service. Negative reviews, however, may point to concerns over the clarity of loan terms, interest rates, and the overall cost of borrowing. Trustpilot’s platform allows for a broad range of feedback, offering a spectrum of user experiences.

General Observations:

- Customer Service: There’s a recurring theme in positive reviews regarding the company’s customer service, suggesting that Union First Funding puts an emphasis on supporting its clients through the loan process.

- Transparency and Expectations: Some negative reviews highlight issues with transparency, especially concerning loan terms and interest rates. These point to the importance of thoroughly reviewing and understanding all loan documents and fine print before committing.

- Varied Experiences: The wide range of reviews underscores the personalized nature of financial services, where individual circumstances heavily influence outcomes and satisfaction levels.

When reading through reviews, it’s crucial to maintain a balanced perspective. Consider both positive and negative feedback, but also reflect on your financial situation, needs, and goals. Keep in mind that, while reviews can guide you, your decision should be based on comprehensive research and personal financial considerations.

Union First Funding Customer Experiences

Exploring the realm of customer experiences with Union First Funding sheds light on the real impact of their debt consolidation and personal loan services. Feedback from actual clients provides a genuine glimpse into the company’s operations, customer service, and the efficacy of their financial solutions. Here’s a compilation of insights gathered from various customer interactions:

Positive Experiences:

- Streamlined Process: Many customers appreciate the straightforward application process and the clarity provided by Union First Funding throughout their debt consolidation journey. The ease of turning multiple debts into one manageable payment is often highlighted as a significant relief.

- Helpful Customer Support: There’s consistent praise for Union First Funding’s customer service team, noted for their responsiveness and helpfulness in answering questions, offering guidance, and providing reassurance throughout the loan process.

Areas of Concern:

- Mixed Messages on Loan Terms: A notable portion of feedback points to discrepancies between initial offers and the final terms presented after the formal application process. Some customers expressed frustration over receiving less favorable interest rates or terms than those initially advertised.

- Impact on Financial Planning: For some, the extended loan terms led to concerns about the long-term financial impact, including the total interest paid over the life of the loan. This aspect underscores the importance of thoroughly understanding loan terms before proceeding.

Navigating Reviews:

- Varied Experiences: It’s clear from customer feedback that experiences with Union First Funding can vary widely. Potential clients are advised to approach reviews with a discerning eye, understanding that individual financial situations and outcomes can differ.

- Due Diligence: Prospective borrowers should use these reviews as one of many tools in their decision-making process. Consulting with financial advisors, comparing offers from multiple lenders, and a deep dive into the fine print are crucial steps in ensuring that a loan from Union First Funding aligns with one’s financial goals and capabilities.

In sum, while many customers have had positive experiences with Union First Funding, the varied nature of feedback highlights the importance of personal due diligence and the value of understanding the broader implications of debt consolidation loans on one’s financial health.

Conclusion

Choosing the right path for managing debt is crucial to your financial well-being. Union First Funding offers options like debt consolidation and personal loans that might seem appealing at first glance. However, as we’ve explored, it’s essential to approach these offers with a critical eye.

Understanding the terms, considering the long-term implications, and comparing alternatives are steps you cannot afford to skip. Remember, the goal is not just to consolidate or reduce your debts, but to do so in a way that aligns with your overall financial health and goals. Make informed decisions, and consider seeking advice from financial advisors to navigate your debt consolidation journey effectively.

FAQs

1. How does Union First Funding’s debt consolidation work? Debt consolidation with Union First Funding involves combining multiple debts into a single loan with a potentially lower interest rate. This process aims to simplify monthly payments and reduce the total amount paid over time.

2. Can I use Union First Funding’s loans for purposes other than debt consolidation? Yes, Union First Funding offers personal loans that can be used for various purposes, including home improvements, major purchases, or emergency expenses, not limited to debt consolidation.

3. Will applying for a loan with Union First Funding affect my credit score? Applying for any loan involves a credit check, which can temporarily impact your credit score. However, responsibly managing your loan and making timely payments can positively affect your credit over time.

4. How long does the loan approval process take with Union First Funding? The time frame can vary based on your specific financial situation and the completeness of your application. However, Union First Funding aims to provide a streamlined and efficient process for applicants.

5. Are there any fees associated with Union First Funding’s loans? It’s essential to review the terms of any loan offer, as fees can vary. Look for origination fees, prepayment penalties, and any other charges that might apply to your loan.

6. How can I contact Union First Funding for more information? You can reach Union First Funding at 877-222-0954 for direct assistance and more detailed information about their services.

7. What should I do if I receive a pre-approved loan offer from Union First Funding? Carefully review the offer, compare it with other loan options, and consider your financial goals and capabilities. Conducting thorough research and possibly consulting a financial advisor can help ensure that it’s the right decision for you.

These FAQs are designed to address common inquiries about Union First Funding, helping you make more informed decisions regarding their loan services.