Liberty Lending Group is a company that offers personal loans to consumers. But is Liberty Lending legit or a scam? That’s what we’re going to find out in this Liberty Lending Group review. We’ll take a look at the company’s history, its products and services, and its pros and cons. So, if you’re considering borrowing money from Liberty Lending, read on for our honest review!

Liberty Lending was founded in 2014 and is headquartered in New York, NY. The company offers personal loans of up to $35,000 with APRs ranging from 12% to 35%.

One of the things we like about Liberty is that they are a direct lender. This means that you will deal directly with the company when you apply for a loan, rather than with a broker or third-party lender.

Another thing we like about Liberty is that they offer a variety of personal loan products. For example, they have loans for debt consolidation, home improvement, and large purchases.

However, there are also some things we don’t like about Liberty Lending Group. First of all, the company has high-interest rates. For example, their debt consolidation loan has an APR of 35%.

Furthermore, the company charges hidden fees. For example, they charge a $15 Origination Fee and a $15 Late Payment Fee.

So, is Liberty a scam or legit? We think they are a legitimate company with some good personal loan products. However, we also think that their high-interest rates and hidden fees make them a less attractive option for borrowers.

Liberty Lending Group Pros and Cons

Liberty Lending Group is a subprime lender that offers high-interest rates and loans to people with bad credit. The company has been accused of bait and switch schemes, where they lure customers in with low-interest rates and then switch them to high-interest rates. Liberty Lending Group has also been accused of predatory lending practices.

The high-interest rates that Liberty Lending Group charges are the biggest con. The average APR for a Liberty Lending Group loan is about 30%, which is much higher than the average APR for a traditional loan. This high-interest rate can make it difficult for borrowers to repay their loans and can lead to even more debt.

Another con of Liberty Lending Group is their bait and switch scheme. Customers have reported being lured in with low-interest rates, only to be switched to high-interest rates after they’ve already signed the loan agreement. This bait and switch scheme can leave customers feeling misled and frustrated.

The last con of Liberty Lending Group is the high fees, which can add up quickly if you’re not careful. Overall, there are more cons than pros when it comes to Liberty Lending Group.

What is Liberty Lending Group?

Liberty Lending Group is a personal loan company that offers high-interest loans to qualified borrowers. It is one of the few personal loan companies that does not require a cosigner or collateral.

The company offers personal loans for any purpose, including debt consolidation, home improvement, and major purchases. Liberty Lending has flexible repayment terms and a variety of loan options to choose from.

If you are looking for a personal loan and have good credit, Liberty Lending Group may be a good option for you. However, because of the high-interest rates, you should only consider taking out a loan from Liberty Lending if you are sure you can repay the loan on time. Otherwise, you may end up paying more in interest than you originally borrowed.

How does Liberty Lending Group work?

They advertise low-interest rates to lure in customers, but then they switch the customer to a high-interest rate loan. This is how Liberty Lending Group makes its money. They prey on people who are desperate for a loan and end up trapping them in a cycle of high-interest debt.

It’s important to be aware of this bait and switch scheme so you don’t fall victim to it. If you’re considering taking out a loan with Liberty Lending Group, make sure you understand the terms and conditions fully before signing anything. Otherwise, you could end up paying way more than you bargained for.

Do your research and be cautious when taking out loans. High-interest rates can trap you in a cycle of debt that’s difficult to break free from. Be aware of bait and switch schemes like the one operated by Liberty Lending Group, and don’t let yourself get scammed.

Who owns Liberty Lending Group?

The question of who owns Liberty Lending Group is a complicated one. The company has a number of different shareholders, including some who are based in foreign countries.

The largest shareholder in the company is an investment firm based in the United Arab Emirates. This firm owns just over 50% of the shares in Liberty Lending Group.

The second-largest shareholder is another investment firm, this time-based in Qatar. This firm owns just under 30% of the shares in the company.

The remaining shares are owned by a variety of other investors, including some individuals and other companies. Together, these shareholders own around 20% of Liberty Lending Group.

So, while there is no one person or organization that can be said to own Liberty Lending Group, the company is ultimately controlled by a small group of investment firms based in the Middle East.

What info does Liberty Lending Group ask for?

If you’re considering taking out a personal loan, you may be wondering what information Liberty Lending Group will need from you. Here’s a quick rundown of the personal loan requirements at Liberty Lending Group:

- You must be a US citizen or permanent resident

- You must be 18 years or older

- You must have a regular source of income

- You must have a valid email address and phone number

- You must have an active checking account in your name

If you meet all of these personal loan requirements, you’ll be well on your way to getting the funding you need from Liberty Lending Group.

What does a loan from Liberty Lending Group do to your credit score?

When you apply for a loan from Liberty Lending Group, the company will do a hard pull on your credit. This hard pull will negatively affect your credit score. The hard pull will stay on your credit report for two years. After two years, it will fall off of your credit report and no longer impact your score.

If you’re considering taking out a loan from Liberty Lending Group, make sure to weigh the pros and cons carefully. A hard pull on your credit can ding your score, so it’s important to make sure that the loan is worth it before you apply.

What are some other things that can affect my credit score?

In addition to hard pulls, there are a few other things that can affect your credit score. Late payments, maxed-out credit cards, and high balances can all lead to a lower credit score. If you’re trying to raise your credit score, it’s important to keep these things in mind.

There are a lot of factors that go into your credit score. Hard pulls can be negative, but they don’t have to be the end of the world. With some careful planning, you can minimize the impact on your credit score.

What are some tips for maintaining a good credit score?

There are a few key things you can do to maintain a good credit score. First, make sure you always pay your bills on time. Late payments can have a big impact on your score. Second, keep your balances low. Maxed-out credit cards can also lead to a lower score. Finally, check your credit report regularly and dispute any errors you find. By following these simple tips, you can keep your credit score high.

How does Liberty Lending debt consolidation work?

Debt consolidation is the process of taking out a new loan to pay off multiple debt obligations. This can be an effective way to save money on interest, as you will typically qualify for a lower interest rate on the new loan.

One thing to keep in mind, however, is that debt consolidation only works if you are disciplined about making your payments on time. If you miss payments or default on the new loan, you could end up paying even more in interest than you were before.

If you’re considering debt consolidation, be sure to do your research and talk to a financial advisor to see if it’s the right option for you. Liberty Lending Group has debt consolidation loans available, however, there is a high-interest rate. This should be considered when debt consolidation is being thought about as an option.

When done correctly, debt consolidation can save you money each month and get you out of debt faster than you could on your own. But it’s not a magic solution, and it’s important to understand the pros and cons before you sign on the dotted line.

Should you trust Liberty Lending mail offer?

It’s no secret that many people are struggling financially these days. So when you get a mail offer from a company like Liberty Lending, it can be tempting to jump at the chance for some quick cash. But beware! This company is known for bait and switch schemes, where they lure customers in with low-interest rates and then jack up the rates once they’ve signed on the dotted line.

If you’re considering taking out a loan with Liberty Lending, do your homework first. Check out reviews online and see if other people have had positive experiences with the company. And always read the fine print before signing anything! Otherwise, you could end up paying far more than you ever anticipated.

Liberty Lending BBB Reviews

The company has closed seven complaints in the last three years, six of which were closed in the last 12 months. When compared to other lenders, this complaint volume is relatively high. And while some of these complaints may have been resolved to the customer’s satisfaction, it’s worth considering whether you want to work with a company that has a history of negative reviews.

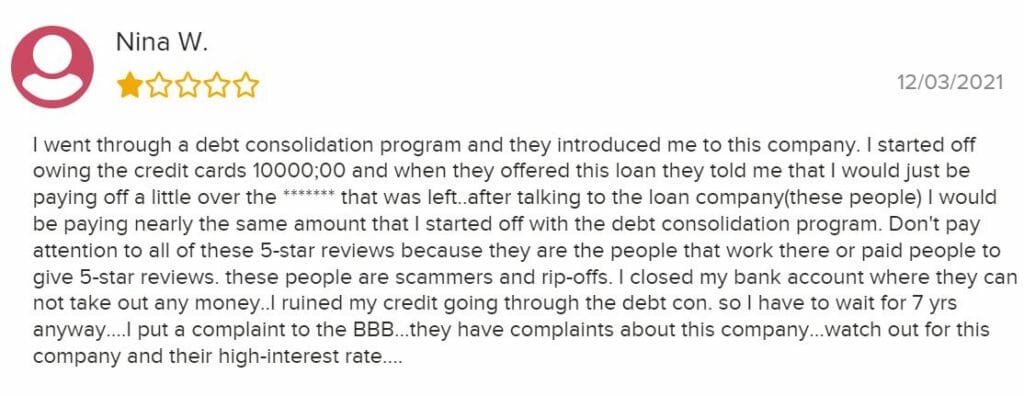

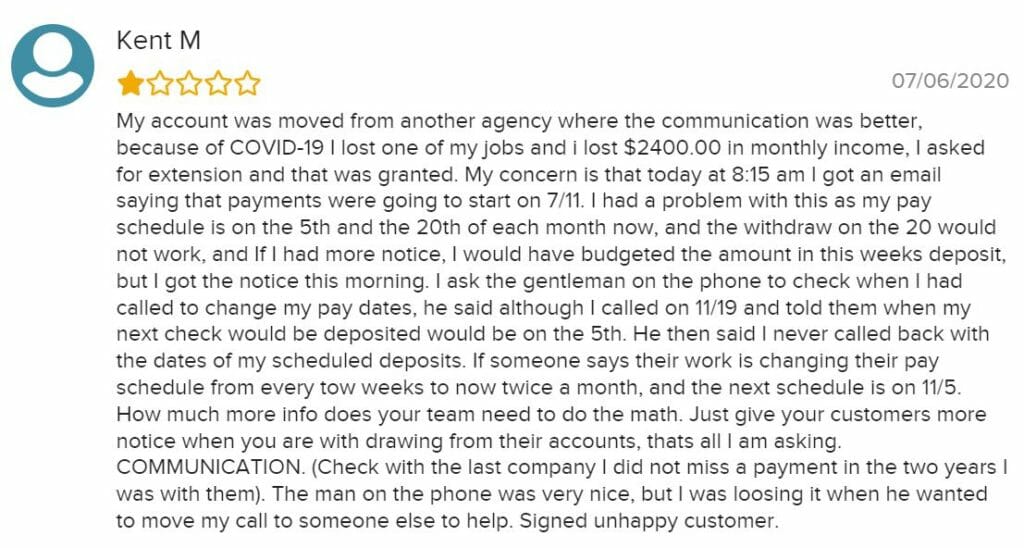

Here are some Liberty Lending BBB Reviews

Is Liberty Lending Group legit?

We investigate the bait and switch scheme that has been used by this company to take advantage of consumers. We also highlight the high-interest rates and hidden fees that come with their loans.

Liberty Lending Group is a company that offers bait and switch schemes to consumers. They promise low-interest rates and then charge high-interest rates once the loan is approved. They also hide fees in the fine print of their contracts. This makes it difficult for consumers to understand the true cost of their loans.

I do not recommend using Liberty Lending. I believe they are not a reputable company and their bait and switch scheme is unfair to consumers. If you are considering using this company, I urge you to read the fine print carefully and be aware of the high-interest rates and hidden fees that come with their loans.

Do you have a story about bait and switch schemes? Share it with me.

Send me an email to [email protected]